6 Critical Trends in Distribution and How to Optimize Your Network’s Response in 2024

From digitalization and changing workforces to trend reversals and inventory imbalances, distributors have their hands full when it comes to tackling the latest supply chain challenges.

Trends in Distribution and the Current Supply Chain Environment

Over the past few years, supply chains have undergone a baptism by fire, having to transform quickly to account for supply shortages, rapidly evolving consumer behaviors, and general disruption. The landscape continues to shift as we approach 2024.

The good news is that supply chain disruption is down. According to MDM, “Supply chain disruption costs fell by roughly 50% for many large companies between 2022 and early 2023.” However, organizations still have to contend with challenges.

- Risk remains a factor. 95% of organizations do not consider themselves to have achieved advanced risk management maturity.

- Disruptions linger. The average yearly cost of supply chain disruptions ranges from $43-47 million.

- Sales have dipped. According to the US Census Bureau, June 2023 sales of merchant wholesalers were down 6.7% from a year before (omitting manufacturers’ sales branches and offices and adjusting for seasonal variation and trading day difference but not price changes).

- The inventory/sales ratio could be better. Although things have improved from the May 2020 high of 1.55, the general trend shows a steady increase since June 2021, with June 2023 sitting at a ratio of 1.41.

Let’s dig into the details and see how modern trends in distribution are shaping the future of the industry.

See you at MDM Shift 2023!

1. AI Elevates Distributor Competitiveness

Going into 2024, forward-thinking distributors are turning to AI and beginning to shift from prescriptive to predictive analytics.

It’s one way companies can differentiate themselves from the competition.

According to James Dorn of the Dorn Group, AI capabilities form the “central nervous system for operating your entire operations.” He draws a line between data interpretation and actual analytics.

In an interview with MDM, he described this shift as “understanding data and analytics through that hindsight review mirror versus foresight windshield type of perspective.”

The prescriptive, hindsight view evaluates past data, customer transactions, and inventory levels.

AI-driven predictive analytics, on the other hand, gathers a wider range of information across customers, products, suppliers, and the marketplace and uses that data to benefit both the business and the customer.

2. Increased M&A Activity

The distribution industry is no stranger to mergers and acquisitions. In fact, in 2021, US industrial distribution M&A activity increased 91% from 2020, and global activity increased 53.6%. Despite more recent decreases in activity, 2023 still remained busy, according to MDM.

M&A can expand your offering and regional footprint, increase your competitive advantage, and prompt business growth.

But this process doesn’t happen overnight.

Multiple ERPs, varying technological solutions, and disparate planning practices require distributors to build a post-acquisition IT roadmap.

Whether they decide to let the ERPs function separately and sync the data outside of these systems, or instead, consolidate everything into one ERP, it’s common for the execution of your IT roadmap to take years.

In today’s rapidly evolving world of supply and demand, that’s far too slow.

Distributors who want the fast track to improved outcomes must prioritize having a singular view of inventory.

The right unified supply chain solution can give you that visibility by integrating with multiple ERPs. By harnessing the power of artificial intelligence and machine learning, companies can improve forecasts and optimize inventory management.

And the best news?

You can start implementing these supply chain planning solutions early in the post-acquisition stages–without waiting two or three years to execute the lengthy, complicated components of your IT roadmap.

TIP: Digital twins are key for optimizing inventory and boosting profits.

Learn how real-time data unification transforms digital twins into supply chain differentiators→

3. Decentralization and the Increasing Importance of Inventory and Network Strategies

All of this M&A activity can exacerbate one of the biggest issues distributors are facing – decentralization.

Distribution tends to be a “boots on the ground” operation. Large distributors have lots of locations, and each location or distribution channel is making individual, autonomous planning decisions.

Because these planners often lack a central strategy and the view of inventory that comes with automated planning solutions, these decisions are being made in silos, leading to inefficiencies that can result in imbalanced inventory and undermine the success of the company as a whole.

Inventory Strategies

During what is most likely a lull in supply chain disruption, many distributors are rethinking their inventory strategies and aiming to achieve higher margins and service levels through more strategic inventory management.

According to McKinsey, many distributors are focusing on customer acquisition and retention through faster delivery times, higher fill rates, broader product portfolios, and higher service targets for important items.

In fact, according to McKinsey’s study, “nearly a third of survey respondents expect to make major investments in capacity and automation in the next three to five years – roughly the same share as those who anticipate investments in digital.”

Many distribution companies are also reevaluating their network design, looking to maximize their use of available resources and space to drive customer satisfaction and network growth.

Digital Transformation

To support these inventory strategies, more and more distributors are beginning to embrace digital transformation – almost 80% of distributors are currently pursuing it.

Distributors that adopt automated solutions, like machine learning and multi-echelon inventory optimization, are able to make planning more collaborative using a single view of inventory that aligns stocking plans throughout the organization.

This degree of visibility and collaboration enables planners to determine optimal inventory levels based on the service level target for each item in a specific location, resulting in increased fill rates, greater control of inventory mix, and reduced costs.

And in this age of inflation, the more effectively you can manage and set your inventory levels, the more you can provide your company with a financial buffer, while still meeting demand and enhancing your customer experience.

4. Preventive Measures for Outmaneuvering Future Disruption

Distributors tend to be more “purchase-focused” than “demand-focused,” with some employing aggressive forward buy tactics.

But, as the last few years have shown, the proven unpredictability of supply chain makes this mindset more of a risk to effective inventory management than ever.

The whiplash of shortages followed by excess inventory levels will most likely not be a thing of the past.

A future bullwhip could wreak havoc on every autonomously operating, decision-making warehouse or distribution center in a decentralized network, resulting in storage fees, obsolescence, and financial losses.

One way to minimize this, besides implementing a solution that provides a single view of inventory, is by making sure you have a central planning team with a defined strategy.

Even better if this centralized team is part of an efficient S&OP process that synchronizes the strategic, tactical, and operational dimensions of your planning processes.

5. Customer Buying Behavior and Omnichannel Trends

Part of the post-pandemic fallout has been the dramatic shift to ecommerce and omnichannel business models.

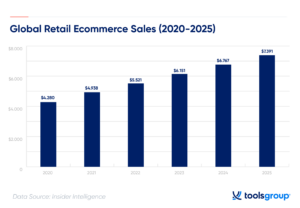

This pattern is demonstrated globally as well, with 2025 worldwide ecommerce sales predictions reaching over $7 trillion.

Distributors face some challenges when it comes to ecommerce, such as lack of visibility into customer behavior and the expense of ecomm initiatives.

However, many distributors are building out successful ecommerce and omnichannel presences to match this growing industry.

Take for instance, Digi-Key, a global, full-service distributor of electronic parts. Besides offering an online shopping portal, this distribution company has also recently expanded its digital support services to customers through Digi-Key’s Marketplace, which “allows suppliers to leverage the Digi-Key website while housing products at their own location” and averages more than 235,000 visitors a day.

This is just one example of how successful distributors are leveraging new technology and ecommerce opportunities to improve service while attracting and retaining a strong customer base.

And considering B2B customers now “regularly use ten or more channels to interact with suppliers (up from just five in 2016),” distributors that invest the time and resources in an effective omnichannel strategy are setting themselves up for success and major payoffs.

6. Attracting and Retaining Top Talent in the Midst of the Labor Shortage

Like the rest of supply chain, distributors are no stranger to the ongoing talent shortage.

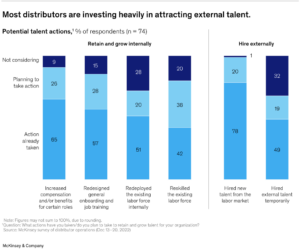

In fact, according to McKinsey & Co., organizations still consider hiring and retention their biggest operational gap.

This is due, in part, to a lack of digitalization. In the same study, about 14% of respondents still rely on spreadsheets requiring intense manual intervention for planning.

Planners are looking for companies that will give them the tools they need to effectively do their jobs.

And this trend isn’t going away.

In one survey, 80% of Gen Z participants (the latest newcomers to the workforce) aspire to work with cutting-edge technology; 91% said technology would influence their decision between similar employment offers.

Distributors have a great opportunity to get ahead of the competition by speeding up their adoption of digital transformation.

It’s important for companies to realize that investing in the right tools and investing in the right people go hand in hand. The right inventory management solution could not only help limit your holding costs but also retain top talent.

Utilizing Distribution Trends To Right-Size Inventory

At the end of the day, distributors need to achieve right-size inventory in order to reduce supply risks, maximize profitability, and build a loyal customer base.

When it comes to achieving this, remember to account for the current distribution trends:

- Embrace AI-powered analytics to ensure you’re making the most of your data, enhancing efficiency and delivering competitive service levels.

- Invest in the right automated forecasting and inventory solutions that can synchronize planning operations, provide a single view of inventory, set optimal stock levels, and reduce grunt work so employees can focus on value-added activities.

- Adapt your business for omnichannel and ecommerce opportunities to better serve the growing base of online shoppers.

Ready to take action on the latest distribution trends? We’ve helped distribution companies like ATD, Harrington Plastic, Moleskine, RAJA and many more navigate uncertainty.

Find out how we can support your digital transformation and business goals!