Mastering Aftermarket Logistics: Overcoming Supply Chain Challenges

The automotive aftermarket industry is facing a series of complex challenges as it evolves. With a projected global market value of USD 568.19 billion by 2032, growing at a 3.5% CAGR from 2024 to 2032, the aftermarket sector is becoming more competitive, especially with the rise of electric vehicles (EVs), increasingly sophisticated technologies, and fluctuating customer demands.

The Aftermarket Landscape: Complexity and Opportunity

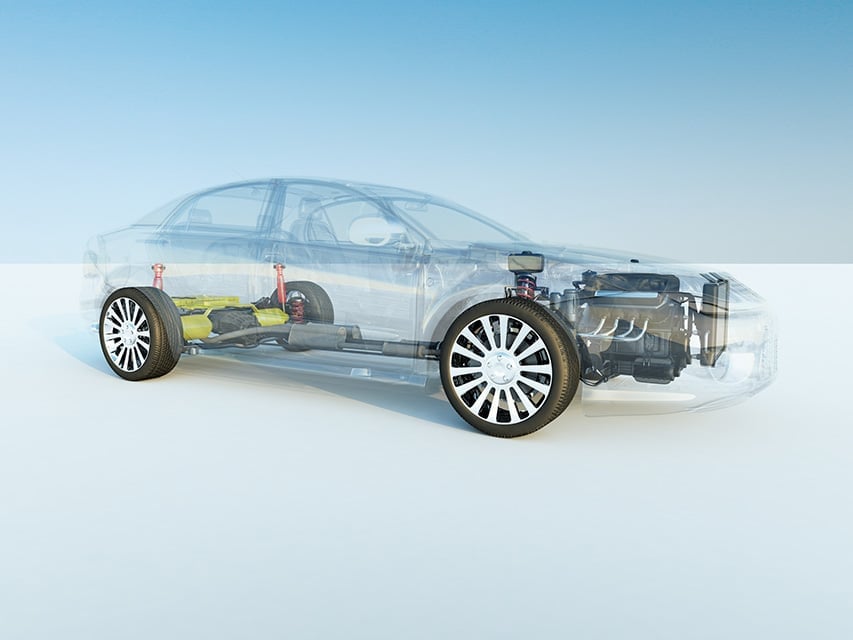

The aftermarket industry encompasses a wide range of products and services, including replacement parts (such as batteries, tires, and brake pads), performance-enhancing components, accessories and vehicle maintenance and repair services.

This sector is driven by several factors, including the ageing vehicle population, the rise of e-commerce platforms, and technological advancements in vehicle manufacturing.

As vehicles age, they require more frequent maintenance, leading to increased demand for aftermarket parts. With a growing number of older vehicles on the road, the aftermarket industry faces greater pressure to optimize supply chains, ensuring critical components like brakes, tires, and batteries are readily available to meet rising demand.

Moreover, the proliferation of e-commerce is reshaping how aftermarket products are purchased. Consumers increasingly turn to online platforms to buy replacement parts and accessories due to the convenience of browsing a wide range of products, comparing prices, and making purchases from home. This shift has led to a growing need for agile inventory management and quick delivery systems.

The Challenges of Inventory Management in the Aftermarket

Managing inventory in the aftermarket is uniquely challenging. Complex distribution networks, multi-echelon supply chains, and intermittent demand for parts complicate supply chain operations. With a vast number of part numbers and vendors, manufacturers must balance maintaining high service levels while controlling inventory costs.

Traditional supply chain planning tools often struggle with these complexities, particularly when it comes to forecasting intermittent demand and addressing the “long tail” of low-volume, high-SKU items.

This is where advanced AI-powered, probabilistic planning becomes essential to forecast demand with great accuracy, even for sporadic or unpredictable orders. This capability is crucial for aftermarket manufacturers, who must manage inventory across various tiers of distribution networks and offer differentiated service levels depending on the needs of different customer groups.

Optimizing Multi-Echelon Inventory with AI

The aftermarket supply chain is inherently complex, with multiple layers—including suppliers, distributors, and retailers—each managing their own inventory.

To navigate this complexity, Multi-Echelon Inventory Optimization (MEIO) offers a cutting-edge solution that enhances inventory management by optimizing stock levels across every stage of the supply chain.

Unlike traditional methods, MEIO provides a comprehensive, system-wide approach that balances inventory across multiple tiers and locations simultaneously. In the aftermarket supply chain, MEIO empowers manufacturers to leverage advanced demand forecasting across the entire network, enabling smarter, data-driven decisions that optimize inventory from raw materials to finished products.

One of the key benefits of MEIO is its ability to recommend optimal “decoupling points” and appropriate stock levels for materials, components, subassemblies, and finished products at various stages of the supply chain. This ensures that the right amount of inventory is available at the right time, minimizing both shortages and excess stock.

The increased visibility that MEIO provides enables centralized demand planning, which not only improves operational efficiency but also reduces costs across the entire supply chain.

While basic inventory optimization is an essential first step, MEIO takes it a step further by strategically aligning service levels with cost efficiency. In the context of the aftermarket supply chain, this means improving customer service while simultaneously reducing inventory holding costs—resulting in a more agile, responsive, and cost-effective supply chain.

Adapting to the Rise of Electric Vehicles and Advanced Technologies

As the automotive landscape evolves, the rise of electric vehicles (EVs) and the increasing complexity of vehicle technology are transforming the aftermarket industry. EVs, with fewer moving parts and less maintenance required compared to traditional combustion engine vehicles, are expected to reduce demand for certain aftermarket products, such as exhaust systems and oil filters. However, EVs also require specialized parts, such as batteries and tires designed to handle the heavier weight of these vehicles.

AI-powered solutions enable manufacturers to adapt to these changes by forecasting demand for new and emerging parts.

For example, advanced tools can predict the demand for EV-compatible components, ensuring manufacturers have the right inventory as more consumers transition to electric vehicles. This flexibility allows manufacturers to stay ahead of market trends and remain competitive in a rapidly shifting industry.

Meeting the Challenges of Global Aftermarket Growth

The global aftermarket industry is expected to grow substantially over the next decade, driven by trends such as increasing vehicle ownership, the aging fleet of vehicles, and the rising popularity of personalized and customized vehicles. In regions like North America, consumers’ preference for vehicle modifications is a significant driver of aftermarket demand.

In this dynamic environment, advanced supply chain solutions are essential for manufacturers to remain competitive. AI-powered platforms capable of managing the complexities of global supply chains allow manufacturers to meet demand across various regions while optimizing inventory levels. These capabilities are crucial as manufacturers navigate challenges such as fluctuating demand, diverse regional regulations, and the need for fast, efficient distribution.

Future-Proofing the Aftermarket Supply Chain

In today’s fast-evolving aftermarket industry, manufacturers must be proactive and adaptable to stay ahead of the competition. The future will bring new challenges—shifting towards data-driven pricing, embracing circularity through recycling and remanufacturing, and catering to fleet operators in the emerging mobility landscape.

As ToolsGroup CEO Inna Kuznetsova added, “Our AI-powered solutions help aftermarket manufacturers navigate uncertainty in today’s rapidly changing market. By leveraging real-time data and analytics, we enable businesses to optimize inventory, maintain high service levels, and reduce costs while adapting to industry shifts. From managing complex supply chains to preparing for emerging automotive technologies, our goal is to equip manufacturers with tools that enhance their competitiveness and agility.”