What’s Your Forecast Accuracy Target?

It seems as if everyone is looking to improve their forecasting performance. Companies are seeking to implement (or re-implement) planning technology solutions, tune and optimize existing methodologies towards tighter variances, and integrate more accurate information into their planning processes. Unsurprisingly, the highest percentage of respondents in Gartner surveys continue to select demand variability and forecast accuracy as top barriers preventing them from reaching their broader supply chain goals.

But despite this growing emphasis on demand forecasting improvement, Supply Chain Planning owners have been asked to manage increasingly volatile and growing portfolios with little to no intelligence on how forecast improvement is impacting their team’s performance potential, according to Ben YoKell of Chainalytics – a ToolsGroup consulting partner who was named by Forbes as one of the America’s Best Management Consulting Firms.

How much can you realistically expect to improve your forecast accuracy each year? And how do you set your targets for the coming year? According to Ben, who oversees Chainalytics’s Integrated Demand and Supply Planning practice (which includes their Demand Planning Intelligence Consortium), many companies take last year’s forecast accuracy metric and simply add a few percentage points to establish the coming year’s goals.

“Forecast accuracy targets are being set by negotiation from historical performance, rather than any real empirical data around what is realistic or even possible for the nature of the demand being forecasted,” says Ben. “This is a little bit like offering a $300k bid on a new house just because the asking price was $350k. What if MLS comps showed the house is only worth $250k? Or what if it’s really worth $400k based on other similar offerings? Companies are setting next year’s planning targets without a data-driven perspective on what is actually achievable.”

YoKell outlines an alternative to relying on a historically-anchored approach. Like a “Zillow for Demand Planning”, he suggest using market intelligence to quantify the relative forecastability of the demand signal to better understand your forecasting performance potential. Ben identifies four key questions to answer:

First, what does good look like? Answering this question requires (1) a data set which can provide the correct basis of comparison (like the MLS in the housing market) and (2) employing an approach that controls for key differences between data points in the data set (like house size, number of bedrooms, bathrooms, in his analogy). For demand planning, the key drivers to understand are about the behavior of the forecasted demand signal.

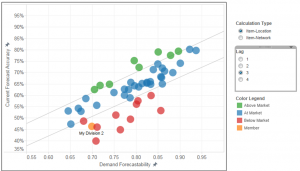

To establish what forecast accuracy is “good”, you need to understand and measure the forecastability of your demand at the item-stocking location level, where order fulfillment actually happens. Then, having modeled and understood your demand behavior, you need a robust data set to measure against which has also been modeled in the same way, controlling for those key differences. In other words, the definition of “good accuracy” will vary by brand, product line, and so on.

Defining “good” requires (1) a basis of comparison,

and (2) controlling for key differences between data points

Second, where should you focus? Neither improvement opportunity nor benefits are evenly distributed across your portfolio. With limited time in each planning cycle (and day), identifying which product lines, items and item-locations can provide the biggest bang for the effort invested is key to succeeding in driving planning performance improvement. At the heart of this is a core belief in segmentation and differentiation. “Deep segmentation provides a more accurate capture of the true demand volatility and drivers of demand forecastability,” YoKell says. “You can then create a differentiated and optimized approach to planning, supported by segment-specific analytics around realistic performance expectations.”

Prioritizing opportunities maximizes return on limited planner time

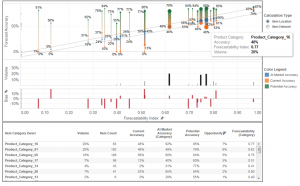

Third, what needs to change? Answering this question requires analyzing the behavior of the errors themselves, so that improvement efforts are targeted at the root causes. Using well-designed data visualization in tools such as Tableau can allow planning teams to literally “see” the behavior of forecasts vs. actuals, trends over time, missed events and over- or under- reactive forecasting processes. Analyzing detailed error and bias behavior across various lags, locations and demand segments in this fashion then leads to rapid identification of the root causes. Forecast Value Add analysis (FVA) can additionally inform where improved information is needed most, and can help both planners and sales, marketing and customer service resources allocate time to where their inputs improve the forecast the most.

Visualization of forecast behavior across forecast lags

drives understanding of root causes and potential fixes

Finally, how should you plan for your demand? Using the results of this demand planning intelligence in conjunction with leading practices, companies can then set realistic fact-based targets. They can charter improvement initiatives customized for the way demand behaves in different areas of the business and product lifecycle stages. They can drive planning improvement, but equally important, they can foster a more intelligent and informed discussion with non-planning stakeholders about:

- Realistic expectations of forecast accuracy and Demand Planning performance

- The amount of collaborative and manual effort required to support desired service

- The number of planners required for a given number of items / item-locations

- Inventory and CapEx required to support desired service levels

- Supply planning agility required to support desired service levels

- Impacts of specific go-to-market strategies and resulting profitability and revenue