Supply Chain Data is a Time-Sensitive Asset. Now We Know Just How Much

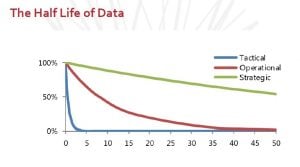

It’s said that “Time is of the essence.” Now a new Nucleus Research report quantifies just how time-sensitive an asset supply chain planning data can be. The Half Life of Data (Anne Moxie, January 2017) describes the deteriorating value of supply chain data. Poring over more than 50 analytics case studies, Nucleus determined exactly how much value is lost if data is not leveraged in a timely manner. It is surprisingly fast.

- For making constant tactical adjustments, the highest initial value of data occurs in the first 30 minutes and deteriorates rapidly after that

- For operational decisions executed over several weeks, data exhibits its best value in the first 8 hours, retaining between 30 and 70% of its initial value after that

- Data for longer-term strategic decisions is best used in the first 56 hours, then retains 70% of its value

Nucleus concludes that “treating data as a time-sensitive asset, and viewing it from the consumer’s point of view, organizations will be able to drive a higher ROI from their analytics and data deployments through better capture and distribution.”

Source: “The Half Life of Data”, Nucleus Research, Anne Moxie, January 2017

At ToolsGroup, we’ve always advocated reduced latency in supply chain planning. This Nucleus report bolsters the argument. The bottom line is that it’s important to get and use data as quickly as possible, moving closer to real-time execution, applying continuous re-planning down to the daily SKU-location level. Gartner calls this “sense and respond”—reducing the latency between sensing demand and execution response to overcome forecasting shortcomings.

One way to do this is to link demand pull signals with replenishment. When sensing demand, downstream data like customer and channel data helps identify demand trends more quickly, provides advanced warning of problems, and lessens latency between the plan and what is actually happening in the supply chain. The quicker deviations can be identified, the faster and more intelligently a company can respond.

At the front end, demand sensing software imports fresh daily demand data and immediately senses demand signal changes compared to a detailed statistical demand pattern. It evaluates the statistical significance of the change and automatically performs short-term forecast adjustments based on probabilistic pattern recognition and predictive analytics.

Making the connection between upstream demand sensing with downstream supply chain planning and execution is best achieved with a single, integrated data model. That way, all the elements of a time-sensitive sense-and-respond supply chain have a single control logic and “DNA,” and can be coordinated without latency. This includes both System of Record (SOR) functions like demand forecasting, and replenishment and System of Differentiation (SOD) functions such as multi-echelon inventory optimization.

One example is the National Health Service (NHS), which implemented a new supply chain planning system for managing the United Kingdom’s blood supply. The NHS transitioned from a push approach to a demand-driven pull method for an around-the-clock SCP network that includes blood components and hundreds of hospitals. Demand is communicated every 15 minutes; the time-sensitive data is translated into a pull signal across distribution, manufacturing, collection, and supply in a “vein-to-vein” system. The automated sense-and-respond supply chain acts on the data right away to order, manage, and replenish blood supplies.

Click below for a more in depth description of supply chains that links demand pull signals with replenishment.