How to Avoid the Most Common Pitfall of Markdowns

Why understanding the principles of price elasticity is especially critical post-pandemic

This year, many companies have recognized the apparent limitations in the traditional ways we do business. Supply chains collapsed, demand became unpredictable, and enterprises worldwide are struggling.

Many companies are reassessing their approaches to supply chain in response to the unpredictable results during the pandemic. Still, too few have recognized the need to apply the same reflection to pricing strategy, especially when it comes to markdowns.

Deep discounting as a survival strategy

According to McKinsey, deep discounting is a primary strategy that retailers are using to survive the retail contraction caused by Covid-19. As we near the holiday discounting season, this trend has strengthened. Deloitte forecasts a 25–35% increase in e-commerce holiday sales this year compared to 2019.

The pandemic hit fashion retailers especially hard. These companies are turning to discounting strategies in even greater numbers than retailers in other sectors. In a typical year, the average fashion company sells about 60% of its stock at full price, 30% at a discount, and the remaining 10% through wholesaling. Boston Consulting Group estimates that this year — and for the foreseeable future — a full 60% of stock will be sold via markdown. Markdowns have now become a critical survival strategy for retailers. Companies cannot afford to make markdown errors.

Poor markdown strategy does more harm than good

And yet non-strategic markdowns abound! A majority of companies still depend on experience, history, individual preferences and perceptions, and simplified analyses to set discounts. These discounts deliver mixed results. When compounded by trends like the rise of anti-consumerism and our bargain shopping culture, it is not clear that the massive discounts that businesses are turning to will ultimately deliver the necessary lift.

In fact, pricing psychology reveals that deep discounts undermine full-price value in the long term. If customers know they can get a much better deal by waiting, why would they ever pay full price? This is especially true in a challenging economy. Since the start of the Covid-19 pandemic, 79% of consumers have indicated that they are looking for more bargains than before, and 46% say they are willing to wait to purchase at a better price “no matter how long it takes”.

Markdowns have almost single-handedly ruined [the fashion] industry. They train the consumer not to buy in-season because they can come back in three months and get a discount. It’s a vicious cycle.”

— Maggie Hewitt, founder of womenswear label Maggie Marilyn

Traditional assumptions about markdowns seldom deliver optimal ROI, creating the most common pricing pitfall. Just because, for example, Black Friday sales supposedly increase purchases every year, it doesn’t mean that a massive Black Friday discount will achieve your profitability goals. In reality, Black Friday often fails to deliver on expectations even though overall revenues on the day grow every year. Habits and history can’t be trusted as much as we think they can.

How do you discount more strategically?

Of course, most businesses can’t afford not to offer markdowns, especially in the face of inventory surpluses created during lockdowns. When done right, markdowns remain an effective part of pricing strategy. So how do you discount more strategically?

It’s all about making data-driven pricing decisions.

Markdowns are most effective when informed by accurate data and analyses that assess their impact on overall company goals. Instead of optimizing sales and attention, businesses need to optimize the overall effect on profits. A critical element of this analysis is an accurate calculation of price elasticity — a measure of the degree to which the demand for a product changes in relation to price.

Why a simple analysis isn’t enough

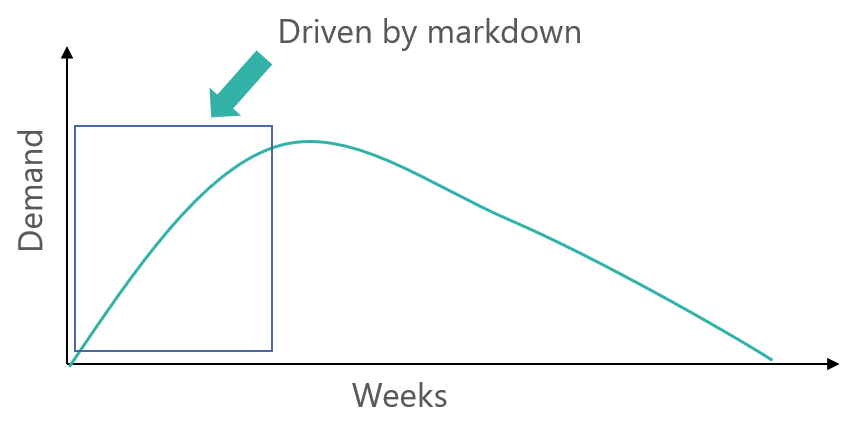

Of course, any good executive understands and leverages the basic principles of price elasticity. The whole rationale of markdowns is driven by a desire to increase its demand — and sales. The problem is that a simple analysis of price elasticity rarely captures the nuances of discounting across a company’s entire inventory.

The profit impact of a particular item marked down in isolation is simple to calculate using standard formulas, but it is much harder to use these traditional methods to assess the overall impact of that discount on the sales of other items. Similarly, it’s easy to see how an across-the-board markdown of 25% will likely impact sales, yet you miss out on the granular insights. This hurts profits on some SKUs, even as you marginally increase profits overall. These simplified traditional analyses inevitably result in missed revenues.

Resolving elasticity complications

So how do you avoid these hidden pitfalls? That’s where AI comes in.

Humans may not have the ability to calculate every individual item’s demand elasticity, but a well-designed algorithm can. When there are gaps in the data needed to calculate a particular item’s price elasticity, the model can use product similarity to assess a reasonable forecast. It can simultaneously analyse the overall impact of pricing strategy to provide a simple recommendation that optimizes profitability from the markdown. Any simple analysis will never come close to replicating these results.

Even during normal years, traditional elasticity calculations will underperform, but this year the gap has grown. Due to lockdowns and erratic demand, the data used for elasticity calculations is less reliable. Corrections must be made to ensure that recommendations remain trustworthy. The average person can not do this at the data-level, but it is possible with the right technology.

Good pricing is like the Rolls-Royce of numbers: the ultimate application of analytics in a corporate environment, driven by rigorous detail with well-engineered mechanisms and excellent results.

— Fabrizio Fantini, Founder and CEO of Evo

How to optimize your own markdowns

As you can see, the best way to avoid the pitfalls of markdowns is to look at price elasticity in a new way. To maximize profitability while using discounts, you have to consider both the granular and the big picture. A custom, AI-driven approach outperforms a one-size-fits-all markdown.

The better you understand price elasticity, the better you can manage markdowns. You can even develop your own model to perform these calculations. If you are ready to take your mastery of this concept to the next level, Evo University has a course all about the complex, AI-driven calculations of price elasticity that I do at work every day. I encourage you to enrol. With US bankruptcies up 33% and 64% of UK businesses at risk of insolvency, optimal markdown strategy matters more than ever.

***

Big thanks to Kaitlin Goodrich.